|

Federal Market Intelligence for Small Business |

|

|

|

|

New analysis:Top 20 federal agencies for contracts with service-disabled vets’ small bizFor contracting with service-disabled veterans, two federal agencies stand out from the pack: the Defense and Veterans Affairs departments.

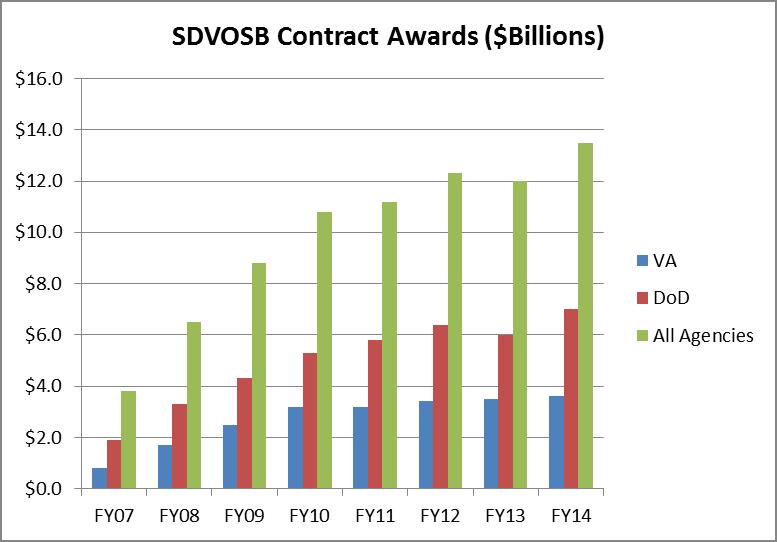

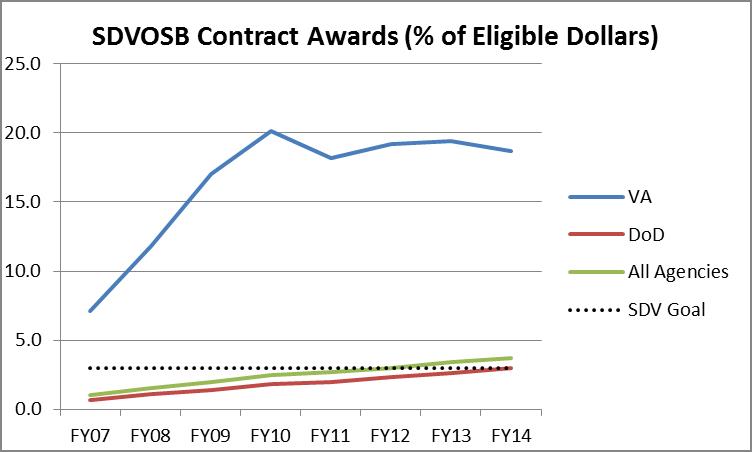

They stand out for different reasons. Defense is the big gorilla--the largest buyer by far of all federal agencies with $7 billion in procurements from service-disabled veteran-owned small businesses (SDVOSBs) in fiscal 2014. But percentage-wise, DOD is just OK. It hit the government’s 3% procurement goal for SDVOSBs for the first time last year. The VA, on the other hand, ranks high on both counts: with $3.6 billion in SDVOSB awards in fiscal 2014, second after the Pentagon, and nearly 19% of awards going to SDVOSBs, the highest in the government. Despite those rankings, many critics believe the VA should do more to help SDVOSBs succeed in the government market. The Supreme Court is hearing a case in November that may enforce a more stringent interpretation of VA’s legal obligations to pursue SDVOSB contracting. Another notable issue is that the VA, under a 2006 law, verifies the elibility of each SDVOSB with whom it does business, while the Pentagon has the ability to contract with thousands of self-certified SDVOSBs in the government’s Small Business Dynamic Search database. Some critics want to consolidate all eligible SDVOSB federal contractors into a single program to reduce confusion and increase efficiency. The DOD and VA both have tripled their SDVOSB contracting from fiscal 2007 to fiscal 2014, mirroring the same trend that occurred for SDVOSB contracting overall (see charts below).

|

Washington Insider:

|

Copyright © 2015 Business Research Services Inc. 301-229-5561 All rights reserved.